The above model is a sample model and does not reveal the underlying brokers, which are permissioned based on your sell-side relationships.

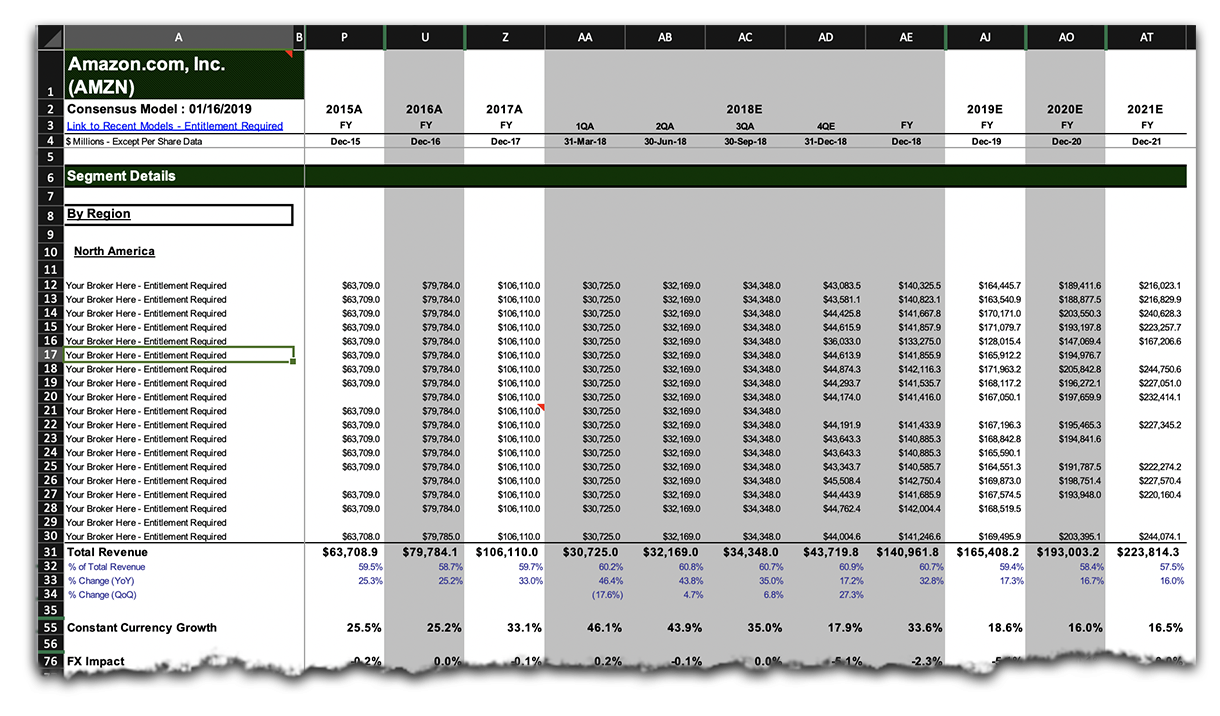

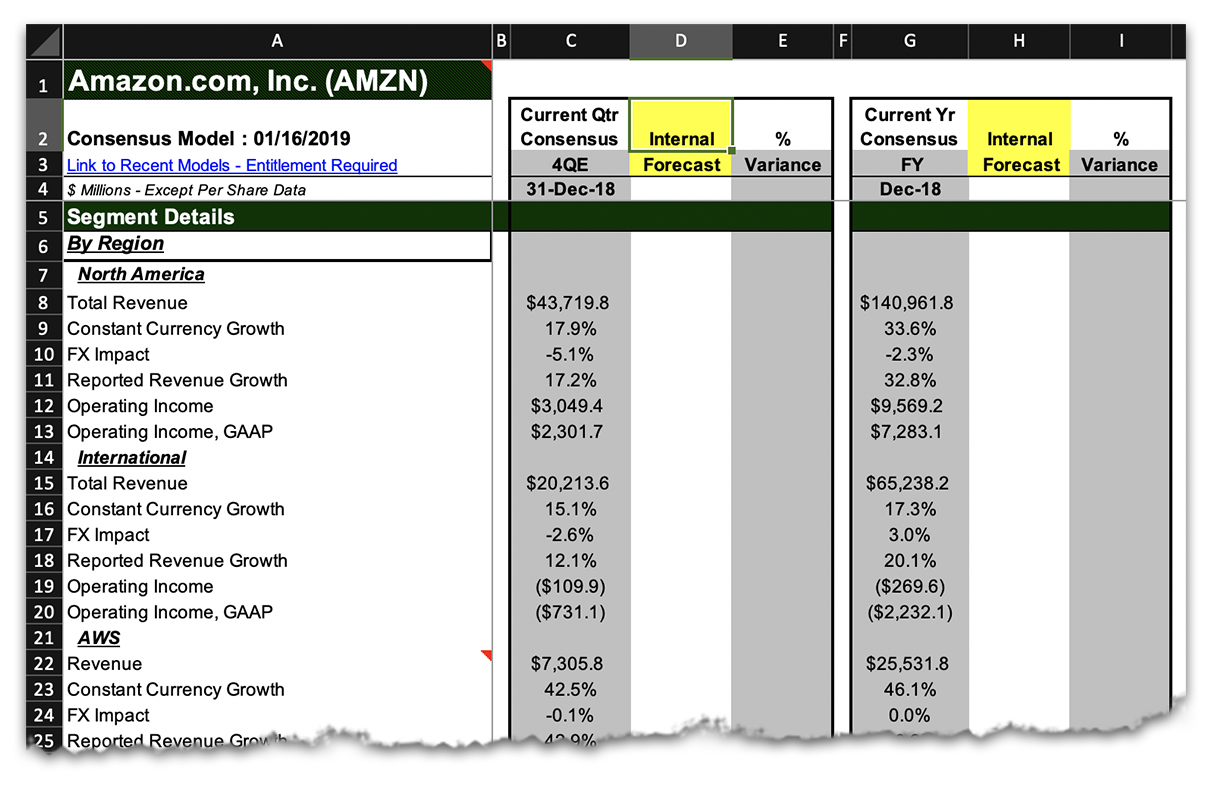

Click to download the sample model for AMZNIf your valuation process requires accurate forecasts of future earnings, you can create the most accurate possible forecasts by averaging the estimates from only those brokerage analysts you know are the most accurate—for over 100 line items, for most companies.

If you trade on surprises, our non-financial metrics and line item surprises can help you make the right decision when a company you are trading reports. Zacks tracks over 50,000 line item surprises, more than any other data service, and we can show you historically how stock prices have responded to surprises.

If you want to talk to brokerage analysts with non-consensus opinions, we can identify those analysts with outlier forecasts for the key metrics that drive prices for any company. If these analysts are right, and you listen to them, you will win big.

If someone at your firm spends time collecting analyst models, we can save your firm a lot of time and money by aggregating sell-side models directly from your brokers, then customizing all broker data, metrics, and formatting to your specifications in a single spreadsheet.

If you are an analyst and build your own company EPS models, we can pre-populate your spreadsheet with the correct company pro forma historical financials to form the starting point for your own model. Then, easily compare your own forecasts at the line item level with brokerage analysts you believe have the best insight to any company.

The above model is a sample model and does not reveal the underlying brokers, which are permissioned based on your sell-side relationships.

Click to download the sample model for AMZN

The above model is a sample model and does not reveal the underlying brokers, which are permissioned based on your sell-side relationships.

We rely on 30 years of gathering and analyzing broker estimate revisions to provide the most comprehensive models available and deliver broader broker coverage.

Competitors simply cannot match Zacks’ scale. We deliver aggregated models customized to your specifications in your time frame, all at a lower cost.

Zacks is one of the largest equity research firms in North America. Daily, we receive electronic data feeds and research reports from 185+ brokerage firms, and from more than 3,200 analysts, amounting to over 500,000 pages of research.

Make your research time more productive with Zacks Consensus Models.

Get Started With Zacks© 2025 Zacks Professional Services

10 S. Riverside Plaza, Suite 1600

Chicago, IL 60606